AUDCHF

WEEKLY TECHNICAL ANALYSIS

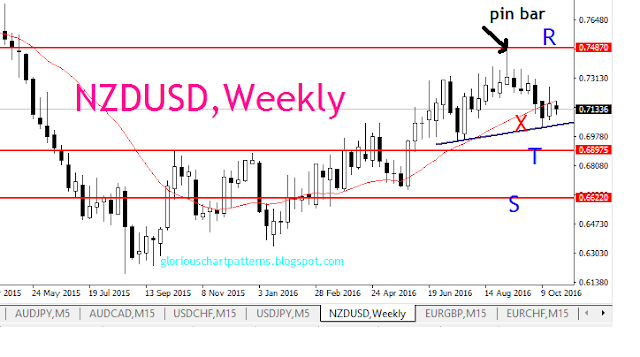

The price is congesting in a triangle marked by the blue trendlines A and B. It is now reacting to the 21 Simple Moving support, the green trendline is next support. Close below the green trendline will price into the bottom of the congestion at B blue trendline. Close below B can lead to the retest of lows into support zone around 0.63893 marked S.

Close above R disqualifies the setup.