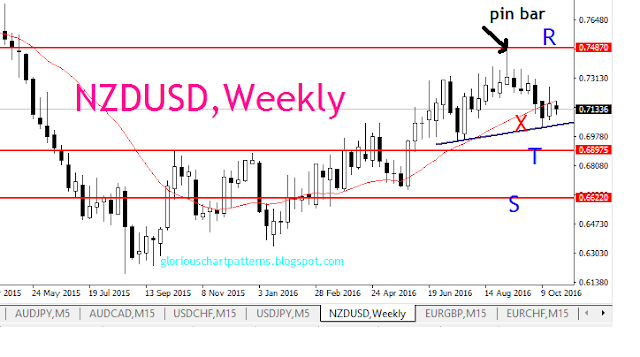

NZDUSD, DAILY

TECHNICAL ANALYSIS

The price is coming into trendline support zone A which is the same support zone as previous congestion. Reaction strength off this zone will determine which the next market direction is highly likely. The chart below shows probability for downside especially if the high formed off reaction on the support trendline zone doesnt go higher than the high marked by the black arrow. Close above R disqualifies the setup.